Retiree Health Benefits

Are you an active employee with questions about retiree health? Contact the FedEx Retiree Health Service Center (RHSC) at 1.888.715.1911. Representatives are available Monday–Friday from 7 a.m. to 7 p.m., CT.

This page provides general information about health care benefits available to eligible employees when you retire from FedEx. In addition to information about the FedEx retiree health benefits for eligible pre-65 and post-65 retirees, this page contains information about public exchanges, Medicare and COBRA, which may be helpful to all retirees, regardless of eligibility. To learn more, expand each section below.

For plan options and rates, view the current enrollment guide on the overview page for your operating company.

The FedEx Corporation Retiree Group Health Plan will close effective January 1, 2024. FedEx will continue to maintain for qualifying retirees the FedEx Corporation Retiree Health Reimbursement Arrangement, featuring the Retiree Health Premium Account (RHPA) that can be used to reimburse eligible health care premiums. Eligible FedEx retirees will still have the option to enroll in health insurance obtained through other sources, like a health insurance exchange, an insurance company, or an insurance broker and use RHPA funds for reimbursement of eligible premiums. FedEx retirees will also have the option to use GetCovered powered by HealthMarkets at 1-866-925-0120 or www.getcovered.com/uhc to find affordable pre-65 medical, dental and vision coverage and post-65 supplemental Medicare plans.

Information on the RHPA including an RHPA expense list can be found on this page.

If you are currently enrolled in the FedEx Pre-65 Retiree Health Plan, your access to the Medical Health Reimbursement Account (HRA) associated with the FedEx retiree medical plan options also will end at midnight on December 31, 2023. If you have funds in your Medical HRA, you must use them before midnight on December 31, 2023, or the funds will be forfeited. You have until December 31, 2024, to submit claims for the 2023 plan year. If you have questions about your Medical HRA or need assistance, contact Optum Financial at 1.833.298.9044 or log on to myoptumfinancial.com/fedex .

Beginning January 1, 2024, eligible FedEx Custom Critical employees who retire at age 65 and older, and have spouses who are age 65 and older at retirement, will be eligible for an RHPA credit of $11,000. This change is an enhancement of the RHPA benefit for Custom Critical retirees. Custom Critical employees who retire at age 65 or older before January 1, 2024, will not be eligible for an RHPA credit.

Please note that the information regarding the Pre-65 FedEx Corporation Retiree Group Health Plan that is below this drop down is only correct through December 31, 2023.

If you have questions, contact the FedEx Retiree Health Service Center (RHSC) at 1.888.715.1911, Monday-Friday from 7 a.m.-7 p.m., Central time.

FedEx offers retiree health benefits to eligible retirees. To be eligible for retiree health benefits, you must retire from an operating company* that offers retiree health coverage, and you must satisfy the following age and service requirements as of your date of retirement:

Note: Retiree health coverage is not available to retirees in the U.S. Virgin Islands and Guam.

ARE YOU ELIGIBLE FOR FEDEX RETIREE HEALTH BENEFITS?

Employees who meet the following requirements are eligible for FedEx retiree health benefits:

If you have worked for multiple FedEx operating companies, years spent working for another operating company count towards your consecutive years of permanent continuous service, as long as there is no break in service, you meet eligibility at the time of retirement, and you retire from an opco that offers this benefit.

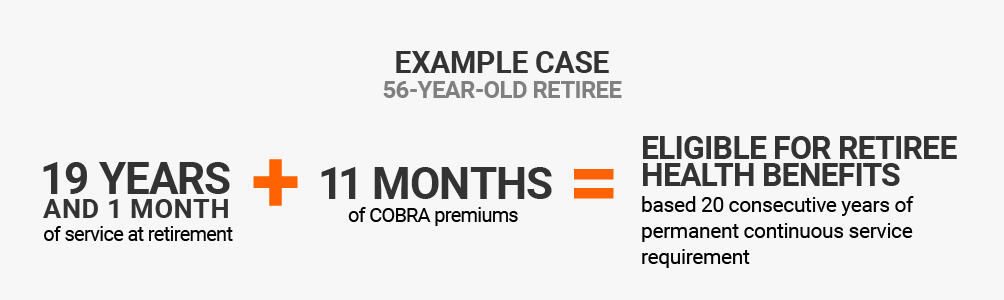

Generally, service with a FedEx company that does not offer retiree health benefits will be counted to determine eligibility. If you do not meet the age and/or service requirements by your retirement date, but you elect to continue your medical coverage through the FedEx Corporation Group Health Plan under COBRA, your COBRA continuation period will count toward satisfying the eligibility age and service requirements for retiree health benefits. Only the period for which COBRA medical coverage premiums are paid will be counted toward the age and/or service requirements. When COBRA is used as a bridge to meet the age and/or service eligibility requirements for retiree health benefits, the FedEx Retiree Health Premium Account (RHPA) credit amount will be determined as of the date you first meet age and service eligibility requirements. Please see the COBRA section of this page for instructions about how to obtain retiree health benefits if you use COBRA continuation coverage to bridge the age and/or service requirements.

Important! Not all retirees are eligible for FedEx retiree health benefits. Employees hired after December 31, 2017, are not eligible for retiree health benefits. Also, retirees who waived coverage (for medical, dental and vision) in the FedEx Corporation Retiree Group Health Plan prior to October 1, 2015 are not eligible for retiree health benefits.

*Participating Employers in the FedEx Corporation Retiree Group Health Plan include FedEx Express (Federal Express Corporation, including team members residing in Puerto Rico); FedEx Services (FedEx Corporate Services, Inc.); FedEx Corporate (FedEx Corporation); FedEx Custom Critical, Inc.; FedEx Dataworks, Inc.; FedEx Forward Depots, Inc.; FedEx Freight Corporation; FedEx Logistics, Inc.; FedEx Trade Networks Trade Services, LLC; and FedEx Trade Networks Transport & Brokerage, Inc. NOTE: Employees of Federal Express Virgin Islands, Inc. and employees domiciled in Guam are not eligible to participate.

FedEx retiree health benefits are available to eligible retirees, their eligible spouse and eligible dependents, and are comprised of two components: The FedEx Corporation Retiree Health Reimbursement Arrangement and the FedEx Corporation Retiree Group Health Plan.

FedEx Corporation Retiree Health Reimbursement Arrangement (RHPA credit)

RHPA credit quick facts

![]()

One-time credit

![]()

Credited entirely by FedEx

![]()

Reimburses you for health care premiums and contributions

![]()

Tax-free account

![]()

Balance based on your age at the date of retirement

![]()

One-time credit for eligible spouse

For pre-65 and post-65 retirees who meet the eligibility requirements for retiree health benefits, FedEx will provide a one-time retiree health credit to a Retiree Health Premium Account (RHPA) when you retire. The account is established and credited entirely by FedEx. However, you must notify the Retiree Health Service Center to activate your RHPA and, if applicable, your spouse’s RHPA as well. You can use the RHPA to reimburse yourself for the cost of your health care premiums/contributions (including Medicare and Medicare supplement premiums/contributions), up to the amount in the account. Because it's a tax-free account, you don't pay taxes on your balance or reimbursements for eligible expenses.

The one-time RHPA credit amount will be determined based on your age on the date of your retirement. Your eligible spouse’s one-time RHPA credit amount is based on his/her age as of your retirement date. Each of you will have your own RHPA, independent of each other.

If any eligible non-spouse dependents are covered, they will not receive their own RHPA, but you and your spouse can use yours to cover their eligible premiums/contributions.

Information about your RHPA will be sent to you via postal mail approximately two weeks after your retirement date along with your enrollment guide for the Pre-65 Retiree Health Plan. Follow the instructions included in your enrollment kit to activate your RHPA. Once the RHPA has been established, you can view the available amount.

Is your spouse a current (active) FedEx employee?

If your spouse is an active FedEx employee, he/she will receive his/her own RHPA credit, based on his/her age as of your retirement date. However, they will not be able to access the RHPA until they terminate employment from all FedEx companies; and they will not receive any additional RHPA credits upon retirement under their own eligibility.

Is your spouse not covered under your FedEx health coverage?

If you’re married on the date of your retirement and your spouse is not a covered dependent under the FedEx Corporation Group Health Plan (for active employees), you’ll need to contact the FedEx Retiree Health Service Center (RHSC) after you retire to complete the spousal verification process so that an RHPA can be established for your spouse.

Refer to the chart below to see RHPA credit amounts.

FedEx Retiree Health Reimbursement Arrangement

Retiree Health Credit Amount by Age (also referred to as RHPA credit)

| Age at Retirement | One-Time Credit Amount Per Covered Individual* |

|---|---|

| 55 or younger** | $39,000 |

| 56 | $37,000 |

| 57 | $35,000 |

| 58 | $33,000 |

| 59 | $30,000 |

| 60 | $27,000 |

| 61 | $25,000 |

| 62 | $22,000 |

| 63 | $20,000 |

| 64 | $18,000 |

| 65 or older | $11,000 |

*Retiree is one "individual," and retiree spouse is a separate individual.

**Only spouse may be younger than age 55.

Keep in mind that the RHPA credit:

- Is a one-time allocation, so you'll need to manage it accordingly.

- Doesn’t earn interest.

- Can’t be taken as a lump sum.

- Isn’t taxable if applied to eligible expenses.

Your RHPA can be used for health care coverage premiums, such as premiums for medical, prescription drug (pharmacy), dental, and vision plans like:

- FedEx Corporation Retiree Group Health Plan

- Medicare

- Medicare Supplement Plus

- Individual health insurance coverage obtained through private exchanges, public exchanges, or other sources (premiums for other employer health care plan coverage are only eligible if the employee premiums are paid on an after-tax basis)

- Cannot be used to pay for:

- Your premiums/contributions paid with before-tax dollars; for example, before-tax premiums paid for coverage through your spouse's group health plan.

- COBRA coverage elected following your retirement.

- Coverage administered by your state exchange or the Federal Health Insurance Marketplace if you intend to qualify for the annual federal premium tax subsidy. (Consult your tax professional; you can contact the RHSC for information about irrevocably suspending your RHPA access for a calendar year.)

Retiree Health Premium Account (RHPA)

Eligible Expenses for Reimbursement

| Expense | Covered? | More Details |

|---|---|---|

| Active FedEx COBRA premiums - Premiums for continuation of group medical, dental, or vision coverage under the FedEx Corporation Group Health Plan (for active employees) | NO |

Premiums for COBRA continuation coverage under the FedEx Corporation Group Health Plan (for active employees) is not reimbursable from the RHPA (i.e., employee retires and extends active coverage through COBRA for 18 months or less). |

| Retiree FedEx COBRA premiums - Premiums for continuation of retiree group medical, dental, or vision coverage under the FedEx Corporation Retiree Group Health Plan | YES |

Premiums for COBRA continuation coverage under the FedEx Corporation Retiree Group Health Plan is reimbursable from the RHPA (e.g., upon the occurrence of a qualifying event, such as divorce, resulting in the spouse losing eligibility for the FedEx Retiree Health Plan; the spouse can choose to extend FedEx Retiree Health Plan coverage under COBRA). |

| Non-FedEx COBRA premiums – Premiums for continuation of coverage under a plan offered by someone other than FedEx, such as the non-FedEx employer of a spouse. | YES |

Premiums for COBRA continuation coverage under a group health plan sponsored by an employer other than FedEx, such as a plan sponsored by the non-FedEx employer of a spouse, is reimbursable from the RHPA. |

| IRMAA and late enrollment penalties | YES |

|

| Long-term care premiums - Premiums paid on a policy for future long-term care needs | NO |

|

| Medicare Part B Premiums | YES |

|

| Medicare Part D Premiums | YES |

|

| Premiums for dental insurance - Premiums paid on an after-tax basis for any type of dental insurance coverage, including premiums for private insurance not provided by an employer | YES |

You must provide proof that the premium is after-tax when a payroll or retirement statement is used to document the dental premium expense. Handwritten or verbal confirmation won't be accepted. |

| Premiums for medical insurance - Premiums paid on an after-tax basis for any type of medical insurance coverage, including premiums for private insurance not provided by an employer and Medicare Part A, C, F, G, K, L, M and N | YES |

You must provide proof that the premium is after-tax when a payroll or retirement statement is used to document the medical premium expense. Handwritten or verbal confirmation won't be accepted. |

| Premiums for vision insurance - Premiums paid on an after-tax basis for any type of vision insurance coverage, including premiums for private insurance not provided by an employer | YES |

You must provide proof that the premium is after-tax when a payroll or retirement statement is used to document the vision premium expense. Handwritten or verbal confirmation won't be accepted. |

| Premiums for prescription drug insurance - Premiums paid on an after-tax basis for any type of prescription drug coverage, including premiums for private insurance not provided by an employer | YES |

You must provide proof that the premium is after-tax when a payroll or retirement statement is used to document the prescription premium expense. Handwritten or verbal confirmation won't be accepted. |

IMPORTANT: This expense list provides general expense items/categories that are eligible for reimbursement under the plan. To view a more detailed list of eligible expenses, please visit https://sig-is.org/

FedEx Corporation Retiree Group Health Plan and FedEx Corporation Retiree Health Reimbursement Arrangement. The FedEx Corporation Retiree Group Health Plan and the FedEx Corporation Retiree Health Reimbursement Arrangement (“Plans”) are governed by formal Plan documents and, in the event of any conflict between this guide and the Plan documents, the formal Plan documents will control. This communication does not alter any terms of the Plans or related agreements. FedEx reserves the right to amend or terminate any of its employee benefit plans, in whole or in part, at any time and for any reason.

If you have questions about your Health Reimbursement Arrangement call 1.888.715.1911.

As your retirement approaches, take time to explore your options thoroughly so you can make the best decision for you and your situation.

FedEx Corporation Retiree Group Health Plan (FedEx Retiree Group Health Plan)

FedEx Corporation Retiree Group Health Plan Coverage Options

![]()

MEDICAL

![]()

DENTAL

![]()

VISION

![]()

NO DEDUCTIBLE IN-NETWORK PRIMARY CARE

![]()

FREE IN-NETWORK PREVENTATIVE CARE

![]()

ELIGIBLE RETIREES AND DEPENDENTS UNDER AGE 65

![]()

HEALTH REIMBURSEMENT ACCOUNT BASED ON COVERAGE TIER YOU SELECT

For pre-65 retirees who meet the eligibility requirements for retiree health benefits, eligible pre-65 spouses and eligible dependents, the FedEx Corporation Retiree Group Health Plan provides medical, dental and vision coverage options. Coverage options are designed to provide retirees with a range of cost and benefit coverage options for you and your eligible dependents under age 65.

The Medical Health Reimbursement Account (HRA), not to be confused with the RHPA under the FedEx Corporation Retiree Health Reimbursement Arrangement, is a key feature of the FedEx Corporation Retiree Group Health Plan. It is another way FedEx helps you manage health care costs. When you enroll in a FedEx retiree medical plan option, FedEx will provide you with a Medical HRA, based on the coverage tier you elect. You will be issued an Optum Financial payment card to pay for qualified medical expenses using your HRA. The HRA cannot be used to pay for prescription drug, dental or vision charges. .

CYC Card Eligible Expenses (Deductibles and Copays)

| Anesthesia | Physical Exam |

| Chiropractic Care | Physical Therapy |

| Flu Shot | Psychiatric Care |

| Hearing Aids | Surgery |

| Hospital Room and Board | Wheelchair |

If you have questions about Optum Financial, call 1.833.298.9044 or go to myoptumfinancial.com/fedex.

If you do not use all of your Medical HRA during the year, any unused balance will roll over to the next year, provided you remain enrolled in a FedEx retiree medical plan option. Effective in 2021, a maximum balance of $1,000 will be rolled over, with earlier balances grandfathered.

Retirees in California also may be eligible for the FedEx Retiree Kaiser medical plan option, which includes an HRA.

For retirees in Hawaii, two health plan options are available through Hawaii Medical Service Association (HMSA). These plan options do not include a medical HRA.

Are you a rehired retiree?

If you are rehired by any FedEx operating company, you cannot participate in any FedEx retiree health plan benefits. Your and your spouse’s RHPA will be suspended effective the date you become active again. Any expense incurred during the RHPA suspension period will not be eligible for reimbursement. When you or your spouse decides to retire and terminate employment from all FedEx operating companies, this suspension no longer applies. However, you must notify the FedEx Retiree Health Service Center to re-activate your RHPA; it will not re-activate automatically.

What to expect

If you are under the age of 65 when you retire, and you are eligible to participate in the FedEx Corporation Retiree Group Health Plan, a retiree health enrollment packet detailing your options and costs, as well instructions on how to activate your RHPA will be mailed to your home address approximately two weeks after your retirement is processed in your operating company’s human resources information system.

If you are covered under the FedEx Corporation Group Health Plan for active employees at the time of your retirement, you will also receive a COBRA packet from BenefitConnect (the COBRA administrator for FedEx), providing the option to continue coverage of your “active” medical, dental and/or vision coverage for you and your covered dependents for up to 18 months. Refer to the COBRA section on this page to learn more. (Note: COBRA coverage is not eligible for reimbursement through the RHPA.)

Also, refer to the Medicare section for additional information that might be applicable to you when you turn age 65.

Important! You are not automatically covered under the FedEx Corporation Retiree Group Health Plan or FedEx Retiree Health Reimbursement Arrangement. To receive pre-65 retiree medical, dental and/or vision coverage for you and/or your eligible pre-65 dependents, you must call the FedEx Retiree Health Service Center at at 1.888.715.1911 by the deadline indicated in your retiree health enrollment packet to make your elections. If you do not make an election before the deadline, you will not be able to enroll in retiree health coverage for yourself or your eligible dependents until the next retiree health annual enrollment period, unless you have a qualifying event (e.g., adoption, marriage, divorce).

To activate your (and, if eligible, your spouse’s) RHPA, log on to retirement.fedex.com/enrollnow or contact the FedEx Retiree Health Service Center at 1.888.715.1911. Note: You do not have to enroll in the pre-65 medical, dental and vision plan options to activate your RHPA.

The COBRA provision allows you and/or your dependents to continue coverage through the FedEx Corporation Group Health Plan (for active employees) if certain qualifying events occur that would result in the loss of any health care benefits in which you were participating at the time of the qualifying event.

COBRA qualifying events include:

- Termination of employment (voluntary or involuntary)

- Retirement

- Death of participant (active)

Medical, dental and/or vision coverage may be continued under COBRA if coverage was in effect on the date prior to the qualifying event. Also, you are eligible to continue your participation in the Health Care Flexible Spending Account (HCFSA) under COBRA only if you have an account balance upon retirement. The HCFSA cannot be continued beyond the end of the plan year in which the qualifying event takes place.

In addition, you might be able to use COBRA medical coverage to bridge your age and/or service eligibility. If you elect to continue your medical coverage under the FedEx Corporation Group Health Plan through COBRA (you generally can continue coverage through COBRA for up to 18 months), your COBRA continuation period will count toward satisfying the eligibility age and/or service requirements for retiree health benefits.

For example, assume you are age 56 and have completed 19 years and one month of service when you retire. If you elect COBRA continuation for medical coverage under the FedEx Corporation Group Health Plan and pay COBRA premiums for 11 months, this period will be counted in determining your continuous service for retiree health benefits eligibility.

For assistance with COBRA prior to retirement, contact the COBRA Service Center (1-877-292-6272).

What to expect

If you are covered under the FedEx Corporation Group Health Plan (for active employees) at the time of your retirement, a COBRA packet will be mailed to your home address providing the option to continue coverage of your active medical, dental and/or vision coverage for you and your covered dependents for up to 18 months (up to 36 months if due to death of active employee). When you receive the packet, you have 60 days from the date on the packet to choose COBRA continuation coverage. If you select COBRA and begin paying the required premium, your coverage will be retroactive to the day you lost your health insurance benefits due to the qualifying event.

You must contact the FedEx Retiree Health Service Center within 31 days of the date your COBRA coverage ends in order to begin your pre-65 FedEx Corporation Retiree Group Health Plan coverage and avoid any lapse of coverage.

If your period of COBRA coverage was used to bridge your age and/or service requirements for eligibility for retiree health benefits, you must contact the FedEx Retiree Health Service Center at 1.888.715.1911 in order to provide the required information to establish your RHPA.

Important! When COBRA is used as a bridge to meet the age and/or service eligibility requirements for retiree health benefits, the RHPA credit amount will be determined as of the date you first meet age and service eligibility requirements.

If this is a new term for you, an “exchange” is simply an online resource where insurance providers advertise and sell their services. There is no uniform model. Some are run by companies and others are run by a state government or the federal government. In some markets, competition among plan providers works in your favor, and there’s a potential for better value and lower rates. This gives you the option to research various coverage options and possibly select different coverage, based on your needs.

Exchange Examples and Options:

- Insurance exchange

- Insurance broker

- Insurance company

- Federal Marketplace

- State-based Marketplace

Public exchanges are accessible to all employees, regardless of eligibility for FedEx retiree health benefits. You can shop for coverage through a public exchange administered by your state or the Federal Health Insurance Marketplace, where you might qualify for the annual federal premium tax subsidy.

If you choose this option, you can’t use both the FedEx Retiree Health Premium Account (RHPA) and the federal premium tax subsidy in the same year. You must choose one or the other. If you choose to use the federal premium tax subsidy, you will still have access to your RHPA the year after you stop using your federal premium tax subsidy.

To see if a public exchange is available in your state, go to healthcare.gov. Open enrollment for 2024 coverage in Federal Health Insurance Marketplace options begins November 1, 2023 and enrollment must be complete by December 15, 2023 to ensure coverage on January 1, 2024.

Learn more about the Federal Health Insurance Marketplace or the federal premium tax subsidy at healthcare.gov.

You can purchase health care coverage from an insurance broker or insurance company. The private exchange through Alight Retiree Health Solutions (ARHS) and its partner eHealth offers post-65 retirees access to additional health care coverage options. As an eligible post-65 retiree, you may find supplemental Medicare medical, prescription drug (pharmacy), dental and vision coverage that’s right for you.

You can also contact GetCovered powered by HealthMarkets for pre-65 medical, dental, and vision coverage and post-65 supplemental Medicare plans at 1.866.925.0120 or by visiting www.getcovered.com/uhc.

Employees who meet retiree health age and/or service eligibility requirements and retire at or after age 65 are eligible for the RHPA under the FedEx Corporation Retiree Health Reimbursement Arrangement, but are not eligible to participate in the pre-65 retiree medical, dental and vision plan options under the FedEx Corporation Retiree Group Health Plan.

That’s because at age 65, you become eligible for Medicare. Don’t worry; you don’t have to navigate the Medicare landscape alone. Alight Retiree Health Solutions can assist you and/or your post-65 spouse in evaluating Medicare supplemental coverage and enrolling in a plan, if desired.

Even if you have reached age 65, your pre-65 eligible spouse and/or eligible dependents still can participate in the FedEx Corporation Retiree Group Health Plan, which offers pre-65 retiree medical, dental and vision coverage options (except dependents of Puerto Rico retirees). You must call the FedEx Retiree Health Service Center at 1.888.715.1911 by the deadline indicated in your retiree health enrollment packet to make elections for your pre-65 dependents.

What to expect

Retirees turning 65 who are eligible for the RHPA or the retiree health plan will be contacted by Alight Retiree Health Solutions for assistance with post-65 health insurance needs.

Approximately 60 days before you or your covered spouse turns age 65, Alight Retiree Health Solutions will schedule an appointment for you and/or your spouse to speak with one of their licensed Benefits Advisors for assistance with evaluating Medicare supplemental coverage and enrolling in a plan.

Alight Retiree Health Solutions will send you a Medicare guide, along with an appointment letter, notifying you of the date and time a Benefits Advisor will call you. Upon receipt, please be sure to contact Alight to confirm your appointment date and time, or reschedule your appointment. Failure to do so will result in your appointment being canceled.

A comprehensive needs assessment with a licensed Benefits Advisor will help you narrow plan choices available to you, based upon your situation and needs. Also, the Benefits Advisor can advise you on next steps and how to enroll.

FedEx partners with several administrators for our retiree health benefits. You may receive communications from them from time to time at your home mailing address or via email, depending on your communication preferences. On rare occasions, we might even contact you by phone, so please make sure you keep all of your contact information (mailing address, email address and phone numbers) current through your human resources information system.

Businessolver is the retiree health enrollment administrator for the FedEx Corporation Retiree Group Health Plan, effective January 1, 2023.

Alight Retiree Health Solutions is a private exchange in partnership with eHealth, as well as public exchanges that offer medical, prescription drug (pharmacy), dental and vision coverage and cost options to fit your needs and budget.

ConsumerMedical is a confidential health information and support resource that provides expert healthcare guidance, reliable medical information and personalized support from their team of doctors, nurses and researchers.

eHealth is Alight Retiree Health Solutions’ partner for access to pre-Medicare health plans. eHealth is considered a leading online marketplace for individual and family health insurance products.

Actives – Current FedEx employees.

Exchange – A marketplace where consumers can review/purchase individual insurance plans offered by various commercial insurance providers. Exchanges can be public or private, and vary by state. A public exchange is run by either a state or the federal government. A private exchange is run by a private company.

FedEx Corporation Group Health Plan – The formal plan name of the health care plan for eligible active FedEx employees and their eligible dependents.

FedEx Corporation Retiree Group Health Plan – The formal name of the pre-65 health care plan for eligible retirees (and their eligible dependents) of the operating companies listed below.

- FedEx Express (Federal Express Corporation, including team members residing in Puerto Rico; excluding team members residing in the U.S. Virgin Islands and Guam)

- FedEx Services (FedEx Corporate Services, Inc.)

- FedEx Corporate (FedEx Corporation)

- FedEx Custom Critical, Inc.

- FedEx Dataworks, Inc.

- FedEx Forward Depots, Inc.

- FedEx Freight Corporation

- FedEx Logistics, Inc.

- FedEx Trade Networks Trade Services, LLC

- FedEx Trade Networks Transport & Brokerage, Inc.

FedEx Corporation Retiree Health Reimbursement Arrangement – The formal plan name of the pre- and post-65 retiree health benefit for eligible retirees; it features a retiree health credit in a Retiree Health Premium Account (RHPA).

FedEx Retiree Group Health Plan – A health plan available to eligible FedEx pre-65 retirees, which offers a selection of retiree medical plan options administered by Cigna; also used as the short name for the FedEx Corporation Retiree Group Health Plan.

Health Care Flexible Spending Account (HCFSA) (under COBRA) – An account that allows you to set aside money to pay for eligible health care expenses incurred by you and/or your eligible dependents. To continue the HCFSA under COBRA after your retirement, you must be a participant in the plan at the time of your retirement.

Medical Health Reimbursement Account (HRA) (Cigna & Kaiser only) – FedEx will credit a specified dollar amount to this account for retirees and their covered, eligible dependents who are enrolled in a FedEx retiree medical plan option; the account can be used to help cover the cost of qualifying medical expenses. Credit amounts are based on coverage tier.

Retiree health credit (RHPA credit) – One-time credit provided to eligible retirees to subsidize your health care premium/contribution payments. The amount you receive is based on your age at retirement. The retiree health credit is placed into a Retiree Health Premium Account.

Retiree Health Premium Account (RHPA) – Account established for your and your eligible spouse’s one-time retiree health credit (RHPA credit).

-

Q. What is one FedEx?

A. One FedEx is an effort to consolidate FedEx Express, FedEx Ground, FedEx Services, and other FedEx operating companies into Federal Express Corporation to streamline corporate structure to unify people and reduce redundancies in processes and policies.

-

Q. Why am I no longer able to enroll in FedEx Retiree Health insurance?

A. The FedEx Corporation Retiree Group Health Plan and FedEx Ground Package System, Inc. Retiree Medical, Dental and Vision Care Plan will close effective January 1, 2024. Year-over-year participant enrollment decline in these Plans has indicated more FedEx retirees are choosing to find health care coverage elsewhere.

-

Q. Where can I find health insurance?

A. You can find health insurance through a health insurance exchange, such as healthcare.gov, an insurance company, or an insurance broker. For help finding pre-65 medical, dental and vision coverage and post-65 Medicare supplemental plans, you can also contact GetCovered powered by HealthMarkets at 1-866-925-0120 or www.getcovered.com/uhc.

-

Q. Will I be able to find health insurance if I have a pre-existing condition?

A. Health insurers generally are prohibited from charging or denying coverage to you or your dependents for pre-existing conditions.

-

Q. What will happen to my medical HRA?

A. You cannot submit claims for expenses incurred after December 31, 2023, to a Medical Health Reimbursement Account (HRA) associated with your FedEx retiree medical plan option coverage. For eligible expenses incurred on or prior to December 31, 2023, you have one year from the date the expense was incurred to submit the claim. If you have questions about your Medical HRA or need assistance, contact Optum Financial at 1.833.298.9044 or log on to myoptumfinancial.com/fedex.

-

Q. I am currently on the FedEx retiree group health plan through COBRA. What will happen to my insurance?

A. Your FedEx COBRA coverage will end with Cigna December 31, 2023, and transfer to United Healthcare January 1, 2024, where you will be covered until you decide to drop, or your COBRA continuation period is exhausted.

-

Q. What is the RHPA?

A. The RHPA is a one-time, lump-sum credit into a notional account based upon your age on your retirement date.

-

Q. Can I use my RHPA if I am receiving or plan to receive the federal premium tax credit for my purchase of a health plan on the federal or a state health insurance marketplace?

A. You generally are not eligible for the federal premium tax credit when you have access to the RHPA. Retirees can irrevocably suspend RHPA access for a calendar year, which may allow eligibility for subsidies like the federal premium tax credit. Consult a tax professional or contact the FedEx Retiree Health Service Center (RHSC) at 1.888.715.1911, available Monday-Friday from 7 a.m. to 7 p.m., CT, for information about irrevocably suspending RHPA access for a calendar year.

-

Q. What expenses can the RHPA be used for?

A. The RHPA credit can be used to reimburse for only healthcare premiums and contributions — such as medical (including Medicare and Medicare supplement premiums), prescription drug, vision, and dental plans — up to the amount in the account. It can also be used to reimburse yourself for healthcare premiums and contributions for plans obtained through a health insurance exchange, an insurance company, or an insurance broker and other eligible insurance plans. If there are any credits remaining in the RHPA once you begin receiving Medicare, you can continue to use the RHPA to reimburse eligible Medicare premiums, premiums for Medicare supplements, and premiums for other eligible coverage. Because it's a tax-free account, you don't pay taxes on your balance or reimbursements. For more on RHPA eligible expenses, visit retirement.fedex.com.

-

Q. Can I use my RHPA to pay other premiums besides medical and prescription drug coverage, like dental and vision coverage?

A. Yes, you can use the RHPA to pay for premiums for medical, dental, vision (on an after-tax basis) and prescription drugs (pharmacy).

-

Q. Can I use my RHPA to pay for other health care expenses besides health care premiums?

A. No, the RHPA is intended to cover some or all of your health care premiums and contributions. It cannot be used for other expenses, even those related to health care. You can view the list of eligible expenses on the Retiree Health Overview page at retirement.fedex.com.

-

Q. How can I check my RHPA balance?

A. You can view your RHPA balance and transactions and manage your reimbursement requests through your My Choice Account. Log on to retirement.fedex.com/enrollnow.

-

Q. How can I learn more about the RHPA?

A. Eligible participants will receive a welcome letter that explains the RHPA and provides helpful account information, including a list of eligible expenses. Once the account is set up at retirement.fedex.com/enrollnow, participants can locate RHPA materials in the document center. Information regarding the RHPA is also available on the FedEx Retirement Hub at retirement.fedex.com. If you have questions about the Retiree Health benefit, please contact the Retiree Health Service Center at 1-888-715-1911.

-

Q. What happens once my initial RHPA funds are exhausted?

A. RHPA funds are a one-time allocation. Once the funds in the credit have been exhausted, no additional funds are allocated.

-

Q. When will my RHPA expire?

A. RHPAs do not have an expiration date. They remain open until the participant exhausts the funds in the account.

-

Q. Is the RHPA taxable?

A. The RHPA is not intended to be subject to income tax. You generally are not subject to taxes on your balance or reimbursements of eligible expenses if you participate in the plan subject to its terms.

-

Q. What happens to the balance of my RHPA when I die?

A. If you have an eligible spouse who survives you, they will become the account holder of the balance of your RHPA. If you don’t have an eligible spouse, the remaining balance will be forfeited and won’t be paid out as part of your estate.

-

Q. Can money be transferred between a retiree account and a spouse account?

A. No, money cannot be transferred between RHPA accounts, but you may submit claims for the retiree and spouse from either account.

-

Q. Where do I go on the website to submit a claim?

A. You can access your MyChoice Accounts and submit a claim online through retirement.fedex.com/enrollnow. On your home page, click the "MyChoice Accounts" button. You can also select "MyChoice Accounts" from the drop-down menu next to your name in the upper right corner of the home page.

-

Q. Who can I call with questions about my RHPA?

A. If you have questions or need assistance, contact the FedEx Retiree Health Service Center (RHSC) at 1.888.715.1911. Representatives are available Monday-Friday from 7 a.m. to 7 p.m., CT.

-

Q. What if I want help outside of the FedEx Retiree Health Service Center hours?

A. You can use Sofia who is available 24/7/365 and will engage with you while you are in the system. She is part of the team as the Chat Assistant. Access Sofia in the MyChoice Mobile App or in the bottom right corner of retirement.fedex.com/enrollnow.

The FedEx Corporation Retiree Group Health Plan and FedEx Corporation Retiree Health Reimbursement Arrangement (Plans) are governed by formal Plan documents and, in the event of any conflict between this communication and the Plan documents, the formal Plan documents will control. This communication does not alter any terms of the Plans or related agreements. FedEx reserves the right to amend or terminate any of its employee benefit plans, in whole or in part, at any time and for any reason.

-

Q. I already have an RHPA. Will I lose my RHPA?

A. No, you will not lose your RHPA, and you will still be able to use it during the transition.

-

Q. What is changing for Custom Critical retirees?

A. The FedEx Corporation Retiree Group Health Plan will close effective January 1, 2024. If you are currently enrolled in that Plan, you will need to find health care coverage elsewhere for 2024 and beyond.

-

Q. I have heard 2024 Custom Critical retirees who are age 65 or older will receive an RHPA. If I previously retired from Custom Critical after I was 65 years old, will I also receive a RHPA?

A. No. Only Custom Critical employees who retire at age 65 or older on or after January 1, 2024, will be eligible for an RHPA credit.

The FedEx Corporation Retiree Group Health Plan and FedEx Corporation Retiree Health Reimbursement Arrangement (Plans) are governed by formal Plan documents and, in the event of any conflict between this communication and the Plan documents, the formal Plan documents will control. This communication does not alter any terms of the Plans or related agreements. FedEx reserves the right to amend or terminate any of its employee benefit plans, in whole or in part, at any time and for any reason.

Legal Disclaimer: Each benefit described here is based on a formal plan document or contract. While this information is intended to be accurate, the benefits discussed here are subject to the detailed provisions of the applicable plan documents. This web page is not a summary plan description or part of a summary plan description. The details of the benefits can be found in the applicable plan documents and/or the applicable summary plan description. If there is a conflict between this communication and the terms of the applicable plan document, the terms of the plan document will control. FedEx reserves the right to amend or terminate any benefit plan at any time and for any reason.