Retiree Health

Are you an active employee with questions about retiree health? Contact the FedEx Retiree Health Service Center (RHSC) at 1.888.715.1911. Representatives are available Monday–Friday from 7 a.m. to 7 p.m., CT.

This page provides general information about the FedEx Corporation Retiree Health Reimbursement Arrangement, featuring the Retiree Health Premium Account (RHPA) for eligible retirees. It also contains information about health exchanges, Medicare, and COBRA, which may be helpful to all retirees, regardless of eligibility. To learn more, expand each section below.

To be eligible for the FedEx Corporation Retiree Health Reimbursement Arrangement (also referred to as the RHPA), you must retire from an eligible operating company* that offers it, and you must satisfy the following age and service requirements as of your date of retirement:

Note: Retirees in the U.S. Virgin Islands and Guam are ineligible.

Generally, service with a FedEx company that does not offer the RHPA will be counted to determine eligibility. If you do not meet the RHPA age and/or service requirements by your retirement date, but you elect to continue your active medical coverage through the FedEx Corporation Group Health Plan under COBRA, your COBRA continuation period will count toward satisfying the eligibility age and service requirements. Only the period for which COBRA medical coverage premiums are paid will be counted toward the age and/or service requirements. Important! The following are ineligible for the RHPA:

- Retirees in the U.S. Virgin Islands and Guam

- Employees hired on or after January 1, 2018

- Retirees who waived coverage (for medical, dental and vision) in the FedEx Corporation Retiree Group Health Plan prior to October 1, 2015

*Participating Employers in the FedEx Corporation Retiree Health Reimbursement Arrangement (Plan) include FedEx Corporation; Federal Express Corporation; FedEx Logistics, Inc.; FedEx Forward Depots, Inc.; FedEx Trade Networks Trade Services, LLC; FedEx Custom Critical, Inc.; and FedEx DataWorks, Inc. NOTE: Employees of Federal Express Virgin Islands, Inc. and employees domiciled in Guam are not eligible to participate.

FedEx retiree health benefits are available to eligible retirees, their eligible spouse and eligible dependents, and are comprised of two components: The FedEx Corporation Retiree Health Reimbursement Arrangement and the FedEx Corporation Retiree Group Health Plan.

FedEx Corporation Retiree Health Reimbursement Arrangement (RHPA credit)

RHPA credit quick facts

![]()

One-time credit

![]()

Credited entirely by FedEx

![]()

REIMBURSES YOU FOR ELIGIBLE HEALTHCARE PREMIUMS

![]()

Tax-free account

![]()

Balance based on your age at the date of retirement

![]()

One-time credit for eligible spouse

For retirees who meet the eligibility requirements, when you retire, FedEx will provide a one-time retiree health credit to a Retiree Health Premium Account (RHPA) under the FedEx Corporation Retiree Health Reimbursement Arrangement for you and your eligible Spouse. The account is credited entirely by FedEx. However, you must notify the Retiree Health Service Center within one (1) year of your retirement date to activate your (and, if applicable, your spouse’s) RHPA. Failure to activate your RHPA within one (1) year of your retirement date will result in the permanent forfeiture of your RHPA. You can use the RHPA to reimburse yourself for the cost of your health care premiums (including Medicare and Medicare supplement premiums), up to the amount in the account. Once your account balance reaches $50, you will have one year to use your remaining funds before your account balance goes to $0. Because it's a tax-free account, you don't pay taxes on your balance or reimbursements for eligible expenses. The one-time RHPA credit amount will be determined based on your age on the date of your retirement. Your eligible spouse’s one-time RHPA credit amount is based on his/her age as of your retirement date. Each of you will have your own RHPA, independent of each other.

If any eligible non-spouse dependents are covered, they will not receive their own RHPA, but you and your spouse can use yours to cover their eligible premiums.

Information about your RHPA will be sent to you approximately two weeks after your retirement. Follow the instructions included in the letter to activate your RHPA. Once your RHPA has been activated, you can view and manage your account online. Meanwhile, you can refer to the RHPA chart included in this section to see RHPA amounts by age.

Is your spouse a current (active) FedEx employee?

If your spouse is an active FedEx employee, he/she will receive his/her own RHPA credit, based on his/her age as of your retirement date. However, they will not be able to access the RHPA until they terminate employment from all FedEx companies; and they will not receive any additional RHPA credits upon retirement under their own eligibility.

Is your spouse not covered under your FedEx health coverage?

If you’re married on the date of your retirement and your spouse is not a covered dependent under the FedEx Corporation Group Health Plan (for active employees), you’ll need to contact the FedEx Retiree Health Service Center (RHSC) after you retire to complete the spousal verification process so that an RHPA can be established for your eligible spouse. Refer to the chart below to see RHPA credit amounts.

Refer to the chart below to see RHPA credit amounts.

FedEx Retiree Health Reimbursement Arrangement

Retiree Health Credit Amount by Age (also referred to as RHPA credit)

| Age at Retirement | One-Time Credit Amount Per Covered Individual* |

|---|---|

| 55 or younger** | $39,000 |

| 56 | $37,000 |

| 57 | $35,000 |

| 58 | $33,000 |

| 59 | $30,000 |

| 60 | $27,000 |

| 61 | $25,000 |

| 62 | $22,000 |

| 63 | $20,000 |

| 64 | $18,000 |

| 65 or older | $11,000 |

*Retiree is one "individual," and retiree spouse is a separate individual.

**Only spouse may be younger than age 55.

Keep in mind that the RHPA credit:

- Is a one-time allocation, so you'll need to manage it accordingly.

- Doesn’t earn interest.

- Can’t be taken as a lump sum.

- Isn’t taxable if applied to eligible expenses.

Your RHPA can be used for health care coverage premiums, such as premiums for medical, prescription drug (pharmacy), dental, and vision plans like:

- Medicare

- Medicare Supplement Plus

- Individual health insurance coverage obtained through health insurance exchanges or other sources (premiums for other employer health care plan coverage are only eligible if the employee premiums are paid on an after-tax basis).

- The RHPA cannot be used to pay for:

- Your premiums paid with pre-tax dollars; for example, premiums paid for coverage through your spouse's group health plan that were reduced from your spouse’s income and not subject to federal income tax.

- Active FedEx COBRA coverage elected following your retirement.

View the RHPA expense list here.

IMPORTANT: This expense list provides general expense items/categories that are eligible for reimbursement under the plan. To view a more detailed list of eligible expenses, please visit https://sig-is.org/

The FedEx Corporation Retiree Health Reimbursement Arrangement (“Plan”) is governed by a formal Plan document and, in the event of any conflict between this guide and the Plan document, the formal Plan document will control. This communication does not alter any terms of the Plan or related agreements. FedEx reserves the right to amend or terminate any of its employee benefit plans, in whole or in part, at any time and for any reason.

If you have questions about retiree health and/or the RHPA call the FedEx Retiree Health Service Center at 1.888.715.1911 Monday−Friday from 7 a.m.−7 p.m., CT. As your retirement approaches, take time to explore your options thoroughly so you can make the best decision for you and your situation.

Are you a rehired retiree?

Active employees cannot participate in the RHPA. If you are rehired by any FedEx operating company, your and your spouse’s RHPA will be suspended effective the date you become active again. Any expense incurred during the RHPA suspension period will not be eligible for reimbursement. When you or your spouse decides to retire and terminate employment from all FedEx operating companies, this suspension can be lifted. However, you must notify the FedEx Retiree Health Service Center to re-activate your RHPA; it will not re-activate automatically.

What to expect

To activate your (and, if eligible, your spouse’s) RHPA, log on to retirement.fedex.com/enrollnow or contact the FedEx Retiree Health Service Center at 1.888.715.1911 Monday−Friday from 7 a.m.−7 p.m., CT.

If you are covered under the FedEx Corporation Group Health Plan for active employees at the time of your retirement, you will receive a COBRA packet from BenefitConnect (the COBRA administrator for FedEx), providing the option to continue coverage of your “active” medical, dental and/or vision coverage for you and your covered dependents for up to 18 months. (Note: COBRA coverage is not eligible for reimbursement through the RHPA.)

COBRA qualifying events include:

- Termination of employment (voluntary or involuntary)

- Retirement

- Death of participant (active)

Medical, dental and/or vision coverage may be continued under COBRA if coverage was in effect on the date prior to the qualifying event. Also, you are eligible to continue your participation in the Health Care Flexible Spending Account (HCFSA) under COBRA only if you have an account balance upon retirement. The HCFSA cannot be continued beyond the end of the plan year in which the qualifying event takes place.

In addition, you might be able to use COBRA medical coverage to bridge your age and/or service eligibility. If you elect to continue your medical coverage under the FedEx Corporation Group Health Plan through COBRA (you generally can continue coverage through COBRA for up to 18 months), your COBRA continuation period will count toward satisfying the eligibility age and/or service requirements for the RHPA.

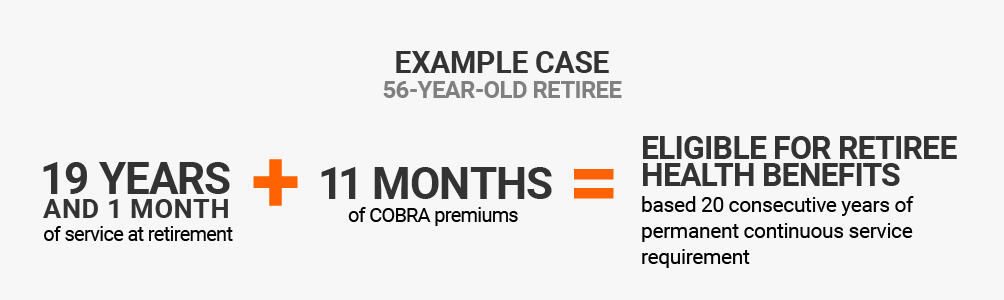

For example, assume you are age 56 and have completed 19 years and one month of service when you retire. If you elect COBRA continuation for medical coverage under the FedEx Corporation Group Health Plan and pay COBRA premiums for 11 months, this period will be counted in determining your continuous service for retiree health benefits eligibility.

When COBRA is used as a bridge to meet the age and/or service eligibility requirements for retiree health benefits, the FedEx Retiree Health Premium Account (RHPA) credit amount will be determined as of the date you first meet age and service eligibility requirements. For assistance with COBRA prior to retirement, contact the COBRA Service Center at 1-877-292-6272 Monday-Friday from 8 a.m.-6 p.m., CT.

What to expect

If you are covered under the FedEx Corporation Group Health Plan (for active employees) at the time of your retirement, a COBRA packet will be mailed to your home address providing the option to continue coverage of your active medical, dental and/or vision coverage for you and your covered dependents for up to 18 months (up to 36 months if due to death of active employee). When you receive the packet, you have 60 days from the date on the packet to choose COBRA continuation coverage. If you select COBRA and begin paying the required premium, your coverage will be retroactive to the day you lost your health insurance benefits due to the qualifying event.

If your period of COBRA coverage was used to bridge your age and/or service requirements for eligibility for retiree health benefits, you must contact the FedEx Retiree Health Service Center at 1.888.715.1911 to provide the required information to activate your RHPA. Representatives are available Monday−Friday from 7 a.m.−7 p.m., CT.

Important! When COBRA is used as a bridge to meet the age and/or service eligibility requirements for retiree health benefits, the RHPA credit amount will be determined as of the date you first meet age and service eligibility requirements.

If this is a new term for you, an “exchange” is simply an online resource where insurance providers advertise and sell their services. There is no uniform model. Some are run by companies and others are run by a state government or the federal government. In some markets, competition among plan providers works in your favor, and there’s a potential for better value and lower rates. This gives you the option to research various coverage options.

Exchange Examples and Options:

- Insurance exchange

- Insurance broker

- Insurance company

- Federal Marketplace

- State-based Marketplace

Public exchanges are accessible to all employees, regardless of eligibility for FedEx retiree health benefits. You can shop for coverage through a public exchange administered by your state or the Federal Health Insurance Marketplace, for which you might qualify for the annual federal premium tax subsidy.

If you choose this option, you can’t use both the FedEx Retiree Health Premium Account (RHPA) and the federal premium tax subsidy in the same year. You must choose one or the other. If you choose to use the federal premium tax subsidy, you will still have access to your RHPA the year after you stop using your federal premium tax subsidy.

To see if a public exchange is available in your state, go to healthcare.gov. Learn more about the Federal Health Insurance Marketplace or the federal premium tax subsidy at healthcare.gov.

You can purchase health care coverage from an insurance broker or insurance company.

You can also contact GetCovered powered by HealthMarkets for pre-65 medical, dental, and vision coverage and post-65 supplemental Medicare plans at 1.866.925.0120 or by visiting www.getcovered.com/uhc.

Employees who retire at or after age 65 are eligible for Medicare. Go to www.medicare.gov or call 1-800-MEDICARE (1-800-633-4227). To request the Medicare part B form or other realted government forms to verify health coverage, contact Choose Well Care Connect at 1.833.FDXWELL (339.9355) or at choosewell.fedex.com.

FedEx partners with third-party administrator(s) for our retiree health benefit/RHPA. Businessolver is the administrator for the FedEx Corporation Retiree Health Reimbursement Arrangement (RHPA). You may receive communications from them from time to time at your home mailing address or via email, depending on your communication preferences. On rare occasions, we might even contact you by phone, so please make sure you keep all your contact information (mailing address, email address and phone numbers) current through your human resources information system. It’s also a good idea to confirm and update your contact information with your benefit administrators when you retire.

Actives – Current FedEx employees.

Exchange – A marketplace where consumers can review/purchase individual insurance plans offered by various commercial insurance providers. Exchanges vary by state. A public exchange is run by either a state or the federal government.

FedEx Corporation Retiree Health Reimbursement Arrangement – The formal plan name of the retiree health benefit for eligible retirees; it features a retiree health credit in a Retiree Health Premium Account (RHPA).

Health Care Flexible Spending Account (HCFSA) (under COBRA) – An account that allows you to set aside money to pay for eligible health care expenses incurred by you and/or your eligible dependents. To continue the HCFSA under COBRA after your retirement, you must be a participant in the plan at the time of your retirement.

Retiree health credit or RHPA credit – One-time credit provided to eligible retirees to subsidize health care premium/contribution payments. The credit amount is based on your age on your retirement date. The retiree health credit is placed into a Retiree Health Premium Account (RHPA).

Retiree Health Premium Account (RHPA) – Account established for your and your eligible spouse’s one-time retiree health credit (RHPA credit).

*The FedEx Corporation Retiree Health Reimbursement Arrangement (Plan) is governed by a formal Plan document and, in the event of any conflict between this communication and the Plan document, the formal Plan document will control. This communication does not alter any terms of the Plan or related agreements. FedEx reserves the right to amend or terminate any of its employee benefit plans, in whole or in part, at any time and for any reason.

Legal Disclaimer: Each benefit described here is based on a formal plan document or contract. While this information is intended to be accurate, the benefits discussed here are subject to the detailed provisions of the applicable plan documents. This web page is not a summary plan description or part of a summary plan description. The details of the benefits can be found in the applicable plan documents and/or the applicable summary plan description. If there is a conflict between this communication and the terms of the applicable plan document, the terms of the plan document will control. FedEx reserves the right to amend or terminate any benefit plan at any time and for any reason.