Retirement benefits

Benefits

Retirement benefits come in many forms. This page will help you understand the types of benefits you may encounter while planning for your retirement.

Please note that the information provided here is general in nature and not specific to your personal FedEx retirement benefits. Refer to your Overview Page for a comprehensive breakdown of the benefits tailored to you.

What retirement benefits are available?

One of the most important things you can do as you plan for retirement is to make sure you consider all your available sources of retirement income.

Here’s an introduction to important pieces of retirement: 401(k), retiree health, pension, and Social Security.

401(k)

A 401(k) plan is a retirement savings account that allows you to divert a portion of your salary into an account you can invest, up to an annual limit. Employers can also make contributions to 401(k) plans. Investment earnings on pre-tax and traditional after-tax contributions to a 401(k) plan are not taxed until you withdraw your money, typically after retirement.

Depending on your plan*, the FedEx 401(k) allows you to make pre-tax and/or Roth contributions and, if eligible, catch-up and/or Roth catch-up contributions through convenient payroll deductions. You may also be able to make traditional after-tax contributions. In addition, your FedEx Participating Employer may contribute an Employer Matching contribution (company match) on a portion of your eligible pay when you contribute pre-tax, Roth and/or, if eligible, catch-up and/or Roth catch-up contributions.

With your 401(k) plan, you can set aside a percentage of your pre-tax income through payroll deductions – that means before you get your paycheck, you’ve already pulled out a portion for your savings and reduced your current taxable income as well. But that’s not all. If eligible, you may be able to also take advantage of catch-up contributions, Roth and Roth catch-up contributions, after-tax contributions, and Employer Matching contributions (Company match) to grow your retirement savings.

You can learn more about 401(k) Maximization on the Video Hub.

Watch your 401(k) add up

$23,500

Contribute the full allowable pre-tax and/or Roth* amount, up to 50% of your eligible earnings.

$7,500

Take advantage of pre-tax, Roth catch-up and/or Roth* catch-up contributions, available the year you turn 50. Save an additional 1 to 30% of your eligible earnings.

1–20%

If your plan allows, you can make after-tax contributions (for those who are not highly-compensated employees, as defined by the IRS).

*The FedEx Corporation Retirement Savings Plans I and II, the FedEx Office and Print Services, Inc. 401(k) Retirement Savings Plan, the FedEx SCA Employees 401(k) Retirement Savings Plan, and the FedEx Corporation Voluntary Retirement Savings Plan (effective January 1, 2026) also give team members the option to make Roth contributions and Roth conversions.

Check the Your Retirement Benefits (YRB) book for your operating company to read specific details about your FedEx retirement savings benefits.

Be sure to register for the FedEx 401(k) plan course that applies to you.

Contributions

When you make contributions to your 401(k), you can choose for your contributions to be deducted from your pay on a pre-tax basis. This means your contributions are not subject to federal income tax or most state and local taxes. As a result, it doesn't actually cost a dollar to save a dollar, because your take-home pay is reduced by less than the amount of your contribution.

You can see the benefits of making pre-tax contributions in the chart below.

SAVING MAY BE EASIER THAN YOU THINK

Pre-tax savings

| Jennifer's paycheck when she does not make contributions to the 401(k) plan |

Jennifer's paycheck when she makes pre-tax contributions to the 401(k) plan |

||||

|---|---|---|---|---|---|

| Monthly earnings | $2,000 | Monthly earnings | $2,000 | ||

| Monthly savings | $0 | Monthly savings | $100 | ||

| Federal withholding | $560 | Federal withholding | $532 | ||

| FICA | $153 | FICA | $153 | ||

| Net take-home pay | $1,287 | Net take-home pay | $1,215 | ||

| Savings | $0 | Savings | $100 | Cost | $72 |

You may contribute up to 50% of your eligible earnings per year, up to the annual maximum. Plus, your 401(k) plan assets grow tax-deferred; so you pay taxes only when you receive withdrawals or distributions from the plan.

The FedEx Retirement Savings Plans I and II, the FedEx Office and Print Services, Inc. 401(k) Retirement Savings Plan, and the FedEx SCA Employees 401(k) Retirement Savings Plan give team members the option to make Roth contributions and Roth conversions.*

Roth contributions allow you to make after-tax contributions. Your contributions will grow tax-free and you can potentially receive your money tax-free in retirement.

Roth in-plan conversions and automatic Roth conversions allow you to convert pre-tax or traditional after-tax money to Roth savings.

Learn more about the Roth features available for your plan, including answers to the following FAQs, by downloading the newsletters below.

- What is a Roth contribution?

- How does a Roth contribution compare to a pre-tax

- contribution or after-tax contribution?

- What are the advantages of Roth contributions?

- Who might benefit from a Roth contribution?

- What are Roth conversions?

FedEx Retirement Savings Plans I and II

Download newsletter

FedEx Office and Print Services, Inc. 401(k) Retirement Savings Plan and FedEx SCA Employees 401(k) Retirement Savings Plan

Download newsletter

*Not applicable for employees residing in Puerto Rico.

If your plan allows, team members who are not highly compensated employees, as defined by the IRS, can also contribute 1 to 20% traditional after-tax or 1 to 10% in Puerto Rico.

NOTE: After-tax contributions are not available in the FedEx Office 401(k) Plan or the SCA Plan.

Do you have a 401(k) account from a previous employer? If you were a participant in a tax-qualified plan of a former employer, you can transfer (roll over) your former account balance to your FedEx 401(k) plan upon meeting certain criteria. However, if you were employed by one of the FedEx Controlled Group Members, you are not eligible to make a rollover contribution from your prior FedEx 401(k) plan.

If you have money in a former employer’s 401(k) plan, this flyer can help you roll that money over to your FedEx 401(k) Plan.

If you want to roll qualified assets into your plan, call Vanguard Participant Services at 1.800.523.1188.

It's not too late to start saving or to save more in your 401(k) plan, especially when your employer provides a Company match. A Company match means when you contribute to your 401(k) plan, your employer contributes, too.

Most FedEx 401(k) plans offer Company match for team members. This means that when you contribute to your 401(k) plan, FedEx may contribute, too. FedEx typically makes an Employer Matching contribution for eligible employees, up to a certain amount of your eligible pay when you make contributions pre-tax and/or, if eligible, catch-up contributions.

Check the Your Retirement Benefits (YRB) book for your operating company to find out just how much FedEx will contribute to your retirement savings.

If you start saving now, you can take advantage of one of the most important elements of long-term saving: compounding. The sooner you start saving in your 401(k) plan, the faster your savings can add up, thanks to the power of compounding.

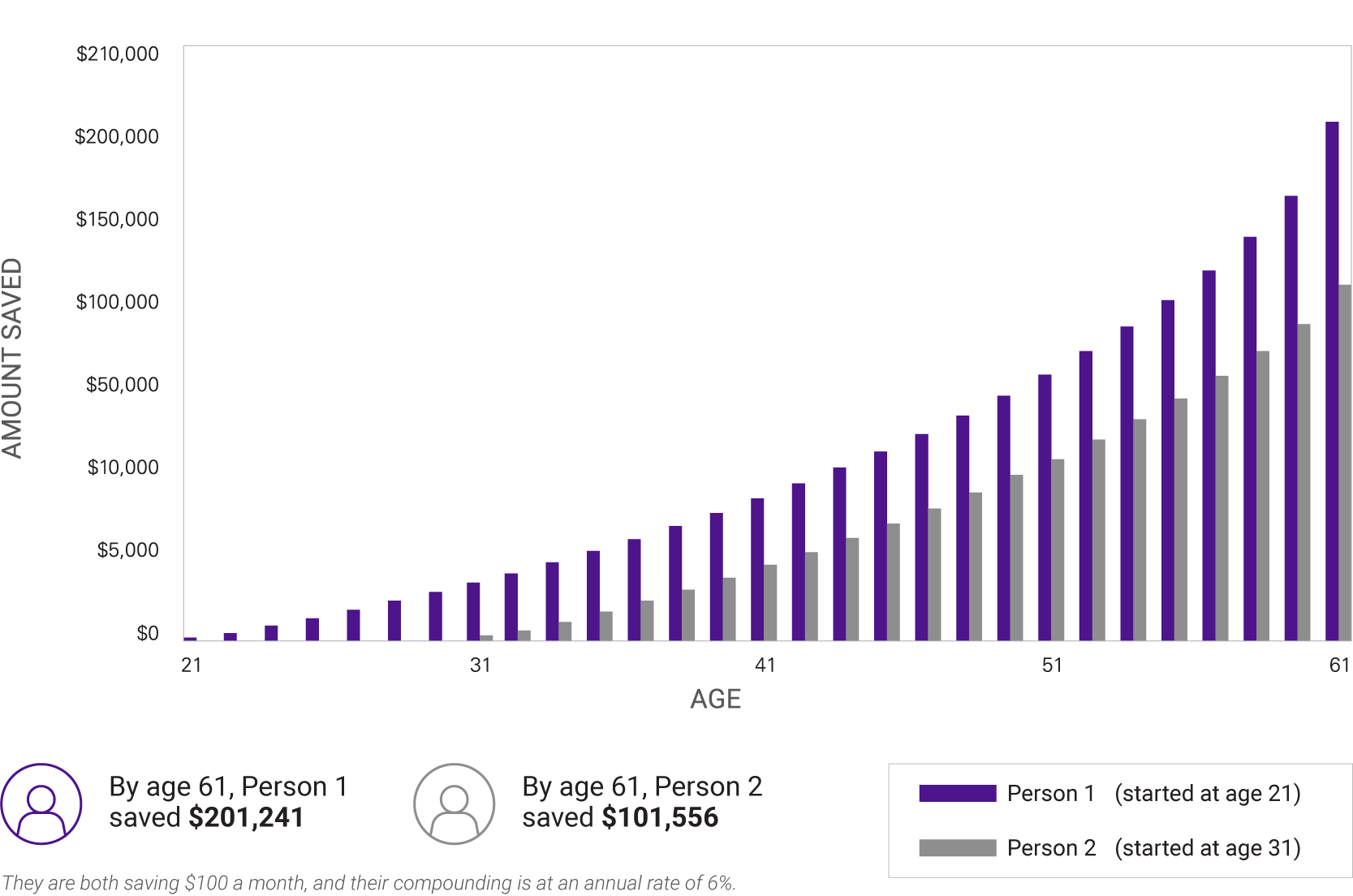

When you start saving early, your savings have more time to grow. Consider Person 1 and Person 2 in the following chart. Both worked for 40 years and invested $100 each month in their company’s 401(k) plan. Both earned an annual return of 6%.*

Person 1 started contributing right away.

Person 2 postponed making contributions for 10 years.

IT PAYS TO SAVE EARLY

It’s rather dramatic to see that Person 1 was able to accumulate $201,241 on her $48,000 investment while Person 2 accumulated only $101,556 on an investment of $36,000. That’s a difference of $100,000 in retirement savings with only $12,000 more in contributions.

*These examples are hypothetical and do not represent the returns from any particular investment. All investing is subject to risk, including the possible loss of the money you invest.

Investment options in the 401(k)

You have a wide range of investment options, and investment changes can be made easily at vanguard.com/retirementplans. When we discuss the investment options in the plan’s investment lineup, we sometimes refer to the investment options in the lineup as “funds.” The lineup of investment options or funds consists of different types of investment vehicles, such as mutual funds and collective investment trusts, that allow investors to pool their resources to purchase multiple assets.

How your money is invested among stocks, bonds and short-term reserves – now and as you grow older – is one of your most important financial decisions. The plan’s investment lineup provides a variety of solutions. You can choose a single all-in-one investment option or create your own mix from the core and/or supplemental investment options.

Read more about the brokerage option and each of the three investment tiers below:

- All-in-one options – Vanguard Target Retirement Trusts

- Core investment options – index-based (also known as passive) and money market investment options, plus a stable value investment option

- Supplemental investment options – actively managed investment options

The FedEx retirement plans include a self-directed brokerage option with brokerage services provided by Charles Schwab. The brokerage option gives you access to individual stocks, bonds, and mutual funds from hundreds of fund families, as well as exchange-traded funds (ETFs). Keep in mind that the risks are substantially different with this strategy and that you’ll have to pay certain commissions and other costs.

To learn more about this option, watch a short video at workplacefinancialservices.schwab.com/content/choosepcra.

Review the pricing guide to learn more about commissions and costs at schwab.com/resource/schwab-personal-choice-retirement-account-pcra-vanguard-pricing-summary.

You can learn more about brokerage service for your FedEx 401(k) plan by downloading the applicable FedEx Brokerage Plan Highlights document.

FedEx Brokerage Plan Highlights (Plan number: 093851)*

FedEx Brokerage Plan Highlights (Plan numbers: 093111; 090381; 093285; 097572; 090155)**

* This document covers the brokerage option for RSP for Puerto Rico. It applies to employees of FedEx Express Puerto Rico (Federal Express Corporation employees residing in Puerto Rico); FedEx Freight, Inc. employees residing in Puerto Rico; and FedEx Logistics, Inc. employees residing in Puerto Rico

** his document covers the brokerage option for both RSP I and RSP II, the FedEx Office and Print Services, Inc. 401(k) Retirement Savings Plan, the FedEx SCA Employees 401(k) Retirement Savings Plan, and the FedEx Corporation Voluntary Retirement Savings Plan. It applies to employees of FedEx Express (Federal Express Corporation, including team members residing in the U.S. Virgin Islands and Guam); FedEx Corporate (FedEx Corporation); FedEx Custom Critical, Inc.; FedEx Dataworks, Inc., FedEx Forward Depots, Inc.; FedEx Freight, Inc.; FedEx Logistics, Inc.; FedEx Office and Print Services, Inc.; FedEx Supply Chain Distribution System, Inc. (includes ATC Information Services, Inc., GENCO Marketplace and Supply Chain); GENCO Infrastructure Solutions, Inc. – Salaried Employees; and GENCO Infrastructure Solutions, Inc. – Hourly Employees.

All-in-one options

Each Vanguard Target Retirement Trust provides a professionally maintained, diversified mix of investments that shift the emphasis to more conservative investments as you move closer to retirement.

By investing your plan account balance and contributions in a Vanguard Target Retirement Trust, you can achieve a diversified portfolio that aligns your plan investments with your goals. The Vanguard Target Retirement Trusts are designed to keep your assets invested appropriately for someone in your stage of life, up to and including your retirement years.

The Target Retirement Trust Funds contain a year in the names. The year in the trust name refers to the approximate year (the target date) when an investor in the trust anticipates retiring and leaving the workforce. When you invest in a Target Retirement Trust, consider choosing the trust with the date that’s closest to the year when you expect to retire. For example, if you think you’ll retire in or around 2040, consider the 2040 fund. If you are already retired, consider choosing Vanguard Target Retirement Income Trust. This investment option is designed to provide retirees with income while preserving the original investment.

You’re not required to choose the fund that matches your projected retirement year. Once you review that fund’s mix of stocks and bonds, you could choose a fund with a later target date if you’d prefer a more aggressive investment mix. On the other hand, if you’d prefer a more conservative mix, you could choose a fund with an earlier target date.

Investments in the Vanguard Target Retirement Trust are subject to the risks of their underlying investment options. The year in the trust name refers to the approximate year (the target date) when an investor in the trust anticipates retiring and leaving the workforce. The trust will gradually shift its emphasis from more aggressive investments (stocks) to more conservative ones (bonds and short-term reserves), based on its target date. An investment in a Target Retirement Trust is not guaranteed at any time, including on or after the target date.

As previously explained, Target Retirement Trust are one-fund options that gradually shift to more conservative investments over time. For a look at how the investment mix changes over time, see the chart in Target Retirement Trusts: a one-fund investing approach from Vanguard.

Your risk tolerance probably will change over time depending on changes in family status, health, life goals, and other factors, so it’s a good idea to periodically check your assets so that you can assess whether the Target Retirement Trust you chose still meets your needs.

If you did not select investment options when you became a participant in the 401(k) plan, your contributions were invested automatically in a Target Retirement Trust, based on your age and an anticipated retirement age of 65.

Depending on how long you have until retirement and any other personal considerations, you should periodically review whether the objectives of the default fund satisfy your investment goals. If you need help establishing investment goals, you might want to check out the periodic webinars from FedEx and Vanguard, review the Vanguard financial education resources at vanguard.com/retirementplans in "Lessons" under "Financial Help" in the menu of the Employer Plans page for your FedEx Retirement Savings Plan, and consider the advice options offered through Vanguard that are discussed below under Resources from Vanguard.

No. It’s important to understand that while the Target Retirement Trust investment options shift to more conservative asset allocations as you approach the target date, they do not guarantee you will have sufficient retirement income on or after the target retirement date. The Target Retirement Trusts continue to have exposure to stocks and equities for the life of the fund. As a result, the Target Date Retirement Trusts reach their most conservative investment mix seven (7) years after the target date.

Each Target Retirement Trust is designed to be the sole investment in your account. A Target Retirement Trust can simplify your investment decisions because it automatically changes your investment mix over time. Based on how long you have until retirement and your risk tolerance, consider whether the objectives of the Target Retirement Trust satisfy your investment goals.

Although Target Retirement Trust can simplify investment selection, whenever you invest, there’s a chance you could lose money. Each Target Retirement Trust invests in several broadly diversified trusts – primarily low-cost Vanguard index investment options – and is subject to the risks associated with these underlying funds. Investments in bond funds are subject to interest rate, currency, country credit and inflation risks. Diversification does not ensure a profit or protect against loss.

For more information about Target Retirement Trust, log in to your account at vanguard.com/retirementplans. Click on Manage my Money, and then select Investments to view all investments available within the plan.

Core investment options

Depending on your personal circumstances, interest, and comfort with investing, you may want to create your own diversified investment mix by starting with the investment options in this tier. The tier is composed mostly of index-based investment options, also known as passively managed options.

Index-based investment options (often called “index funds”) generally use a buy-and-hold strategy to try to track the performance of a given market. In other words, these investment options replicate as closely as possible a particular index (for example, the S&P 500). Why would anyone invest in an index fund and earn just what the market earns? Because index funds generally cost less to run than actively managed investment options, managers of which try to outperform the market. That means index funds can provide low-cost access to broad segments of the stock and bond markets.

You may create your own portfolio mix by choosing from this tier alone or in combination with investments in the Supplemental options.

The core investment options, like all plan investment options, are not guaranteed and subject to risk.

Supplemental investment options

If based on your interests, personal circumstances, and available time, you are comfortable with developing your own retirement plan investment portfolio, the investment options in this tier are actively managed and can help you diversify and fine-tune your investment mix with more specialized investments.

In actively managed investment options, the investment managers select specific investments with the goal of outperforming an investment benchmark (for example, the S&P 500). Because more work goes into researching and choosing specific investments, an actively managed investment option can cost more to run than passively managed investment option. But specific funds can be useful if you want to invest in a specific segment of the stock or bond markets.

Select or change your investment options

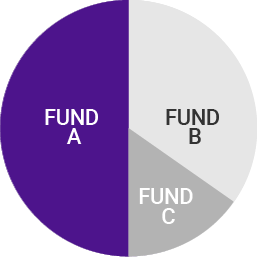

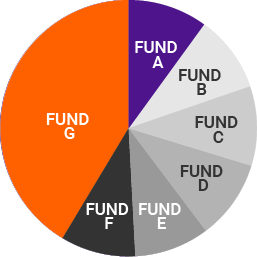

The 401(k) investment lineup is organized into three tiers: all-in-one, core and/or supplemental options. You may choose a single all-in-one investment option or create your own mix from the core and/or supplemental investment options, as long as the total equals 100%, such as:

FUND A

45% FUND A

AND 55% FUND B

50% FUND A

AND 50% FUND B

50% FUND A, 15% FUND B,

AND 35% FUND C

10% FUND A, 10% FUND B,

10% FUND C, 10% FUND D,

10% FUND E, 10% FUND F

AND 40% FUND G

Note: Selections may be made in 1% increments.

There are two ways you can change your investment choices:

- You can transfer your existing balance among your investment fund options.

- You can also change your investment choices for future contributions at any time.

Each investment change is independent of the other. To change both existing balance and future contributions, you must make two independent changes. They may be made any day, 24 hours a day, subject to limitations, as set forth in each fund’s prospectus. However, you can change your investment choices for your existing balances only once during any business day. Once you have made a change in your investment choices for your existing balances, you must wait until the following business day to make another change. Please refer to the Your Retirement Benefits book (YRB) to learn more about the Competing Funds Policy and the Frequent Trading Policy.

To view a complete list of available investment options, log in to your account at vanguard.com/retirementplans. Click on Manage my Money, and then select Investments to view all investments available within the plan.

For more information about any FedEx 401(k) plan investment option, including investment objectives, risks, charges and expenses, call The Vanguard Group at 1.800.523.1188 to obtain a prospectus or fact sheet. The prospectus or fact sheet contains this and other important information about the investment option. Read and consider the prospectus information carefully before you invest. You can also download Vanguard fund prospectuses at vanguard.com.

Vanguard provides an automated service that allows you to select or change your investment options. Changes can be made any day, 24 hours a day, online at vanguard.com/retirementplans or by calling Vanguard’s VOICE® Network at 1.800.523.1188. You can also speak to a Vanguard associate between 7:30 a.m. and 8 p.m. Central time, Monday through Friday, by calling Vanguard at 1.800.523.1188.

If you make elections/changes before the stock market closes (normally 4 p.m. Eastern time), your elections/changes are based on that day’s closing price. If you make elections/changes after the stock market closes, your elections/changes will be based on the next business day’s closing price.

When the stock market closes before 4 p.m. Eastern time, any elections/changes made before closing are based on that day’s closing price. Elections/Changes made after closing are based on the next business day’s closing price.

Vanguard will send a written confirmation of your elections or changes to your home address within seven business days.

Contact Vanguard – 401(k) Assistance

1.800.523.1188 Monday thru Friday, 7:30 a.m. to 8 p.m. Central time

vanguard.com/retirementplans

Spanish speaking: 1.800.828.4487

Hearing impaired: 1.800.749.7273

Managing your 401(k)

Go to vanguard.com/retirementplans. Click "Enroll in Your Retirement Plan." Please note you will need your Social Security number and plan number to complete the enrollment process.

FedEx may have made it easier for you to save in your 401(k) plan through a feature called One Step, which includes automatic enrollment and automatic annual increases, as well as a default investment selection. Check the Your Retirement Benefits (YRB) book to see if your plan includes automatic enrollment features.

*Employees who participate in the RSP for Puerto Rico, FedEx 401(k) Plan, SCA Plan, and FedEx Corporation Voluntary Retirement Savings Plan are not eligible for One Step.

A fully digital, comprehensive advice service that offers you a personalized financial plan and the peace of mind that comes with having ongoing money management tailored to all your personal needs and goals – not just retirement.

Go to vanguard.com/retirementplans.

*Employees in the FedEx Retirement Savings Plan for Puerto Rico, employees in the FedEx SCA Employees 401(k) Retirement Savings Plan, and employees who have an address outside of the United States, or a mailing address in Guam or the U.S. Virgin Islands, are not eligible.

If you want the benefits of Digital Advisor combined with a personal touch, Personal Advisor might be for you. You’ll get ongoing access to our advisors, who will manage your money and help you tackle your most complex financial issues.

Go to vanguard.com/retirementplans or call 1.800.310.9228.

*Employees in the FedEx Retirement Savings Plan for Puerto Rico, employees in the FedEx SCA Employees 401(k) Retirement Savings Plan, and employees who have an address outside of the United States, or a mailing address in Guam or the U.S. Virgin Islands, are not eligible.

If you want to speak with an advisor about a financial situation that pops up, Situational Advisor has you covered. You can get help with any financial topic, from buying a house to saving for college, and more. Your advisor will give you recommendations that you can put into action.

Go to vanguard.com/retirementplans to schedule an appointment online.

Vanguard’s Investor Questionnaire can provide asset allocation recommendations based on your time horizon and risk tolerance. You may access the Investor Questionnaire online at vanguard.com/assetmix at no cost.

Log in to your account at vanguard.com/retirementplans. Review the Vanguard financial education resources available in “Lessons” under “Financial Help” in the menu of the Employer Plans page for your FedEx 401(k) plan.

You can change the amount you contribute to the 401(k) at any time. Contact Vanguard at 1.800.523.1188 or at vanguard.com/retirementplans to:

- Increase or decrease your contribution percentage(s)

- Stop your contributions

- Re-enroll if you have stopped your contributions

Your contribution change will begin as soon as administratively possible.

Steps to change the amount you save

Call Vanguard at 1.800.523.1188.

Have your Social Security number, plan number and PIN ready. Vanguard's interactive VOICE® Network will guide you through the enrollment process for payroll deductions and investment options. (If you wish to speak with a Vanguard associate at any time during the call, press 0.)

Written confirmation of your payroll deduction and investment choices will be mailed to you within seven business days.

Contact Vanguard online at vanguard.com/retirementplans. You will need to be registered. You will need your Social Security number and plan number to register.

- Enter username and password.

- Click "Change My Payroll Deductions"; then follow online instructions.

For more information or if you have questions, call Vanguard at 1.800.523.1188.

NOTE: Refer to the following lists to find your plan number.

How do I find my plan number?

FedEx Corporation Retirement Savings Plan for Puerto Rico (RSP for Puerto Rico) – 093851

- FedEx Express Puerto Rico (Federal Express Corporation employees residing in Puerto Rico)

- FedEx Freight, Inc. employees residing in Puerto Rico

- FedEx Logistics, Inc. employees residing in Puerto Rico

FedEx Office and Print Services, Inc. 401(k) Retirement Savings Plan (FedEx 401(k) Plan) – 093285

- FedEx Office and Print Services, Inc.

- FedEx Supply Chain Distribution System, Inc., includes employees from ATC Information Services, GENCO Marketplace and Supply Chain Logistics & Electronics

- GENCO Infrastructure Solutions, Inc. – Salaried Employees

FedEx SCA Employees 401(k) Retirement Savings Plan (SCA Plan) – 097572

- GENCO Infrastructure Solutions, Inc. – Hourly Employees

FedEx Corporation Voluntary Retirement Plan – 090155

- Federal Express Corporation (excluding employees residing in Puerto Rico)

If you were hired/rehired on or after January 1, 2020 or elected the “all 401(k) plan” retirement benefit structure during the 2021 Retirement Choice period, you participate in the FedEx Corporation Retirement Savings Plan II (RSP II) and use the following plan number: 090381.

FedEx Corporation Retirement Savings Plan I (RSP I) – 093111

FedEx Corporation Retirement Savings Plan II (RSP II) – 090381

- FedEx Express (Federal Express Corporation, including team members residing in the U.S. Virgin Islands and Guam)

- FedEx Services (FedEx Corporate Services, Inc.)

- FedEx Corporate (FedEx Corporation)

- FedEx Custom Critical, Inc.

- FedEx Dataworks, Inc.

- FedEx Forward Depots, Inc.

- FedEx Freight Corporation

- FedEx Freight, Inc.

- FedEx Ground (FedEx Ground Package System, Inc. – excluding package handlers)

- FedEx Logistics, Inc.

It is important that you name the person or persons you wish to receive benefits upon your death. You can name your beneficiary(ies) online at vanguard.com/retirementplans. To choose a beneficiary or make a change to your current election for your FedEx 401(k) plan, select “Menu,” “My Profile,” and “Beneficiaries” once you have logged in to your account.

You have multiple options to take your money out:

*Go to vanguard.com/retirementplans for more information.

Distributions that you elect to take from your 401(k) account generally are eligible for rollover to an IRA or another employer-sponsored retirement plan, unless the distributions are spread over your life expectancy or over a period of 10 years or more, or made to satisfy federal tax rules requiring minimum distributions following your required minimum distribution age, which is dependent on the age at which you must begin taking required minimum distributions.

If you have made Roth contributions and/or Roth catch-up contributions, or you have taken advantage of the Roth conversion feature for your Retirement Savings Plan (RSP I and RSP II), you may be eligible for tax-free distributions. Withdrawals are tax-free, as long as it has been at least five years since you made your first Roth contribution or five years from each conversion and you meet one of the following conditions:

- You are at least age 59 1/2 when you take the money out.

- You become disabled.

- The withdrawal is paid to a beneficiary on or after your death.

You can learn more about 401(k) Distribution Options on the Video Hub.

When making decisions about your 401(k) plan, don’t go it alone. Your situation is unique. Talk to the retirement experts at Vanguard, and seek tax advice or the help of a professional financial advisor about the strategy that’s right for you.

There are several advice services options for participants of the FedEx 401(k) plans. For more information, log in to your account at Vanguard, or call Vanguard Participant Services at 1.800.523.1188 (Monday through Friday, 7:30 a.m. to 8 p.m. Central time).

Social Security

Depending on how long you've been working, you may be eligible to receive Social Security retirement benefits. The amount of your Social Security benefits is based on your earnings averaged over your working career and the age you begin receiving benefits.

For an introduction to The Basics of Social Security, visit the Video Hub.

You can also learn more about Social Security benefits in the Timeline to Retirement course from Vanguard. Check the Course Offerings page to register.

Social Security replaces only about 40% of retirement income for a typical retiree, but the percentage can vary widely depending on how much you earned during your career.

That’s why some retirement experts advise you to meet your retirement needs with income from a pension plan (if applicable), a 401(k), and other investments – and view your Social Security benefits as an added bonus.

To estimate how much money you'll receive in monthly Social Security payments:

- Decide when to begin benefits. (Before you decide, consider your financial and healthcare needs and if you'll work in retirement and other factors.) If your benefits begin:

- At age 62, you'll receive lower monthly payments for a longer period of time.

- Between ages 66 and 67 (depending on the year you were born), you'll receive higher monthly payments for a shorter period of time.

- Visit the Social Security website ssa.gov and estimate your benefit amount.

- Remember that premiums for Medicare Part B medical coverage will automatically be deducted from your monthly Social Security check.

Your work history directly impacts your future Social Security benefits. For every year you work, you earn work credits, and your earnings are recorded. Social Security uses this information to calculate your benefit.

You need at least 40 credits (10 years of work for most Americans) to qualify for retirement benefits. The 35 years with your highest earnings count toward your benefit calculation.

If you have income recorded for fewer than 35 years, the benefit calculation assigns a zero value for each year short of 35. For example, if you have income recorded for only 30 years, the benefit calculation averages that income with 5 years of zero income.

It’s important to check your credits and recorded earnings. Make sure they are accurate. If they are not accurate, inquire immediately.

You have three years, three months, and 15 days after the year in which the wages were paid or the self-employment income was derived to correct earnings. After that, generally, your earnings record cannot be changed. Check your Social Security account earnings records and get an estimate of benefits here.

When you decide to start receiving your Social Security benefits and whether you continue to work after starting your Social Security benefits matter. When you get closer to retirement age, you will want to check your income record for your 35 highest paid years. You may decide to work additional years in order to:

- Replace a low-income year with a higher income year

- Replace a zero-income year with a higher income year

- Increase your payments if you delay starting the benefit beyond your full retirement age, up to age 70.

When you need to apply for Social Security benefits depends on when you want payments to begin:

- To begin payments at age 62, contact the Social Security Administration in advance to determine which month is best to start. (In some cases, the timing can affect the benefit amount.)

- To begin payments at any other time, apply for benefits three months before you want to receive the first payment.

Options for when to take your Social Security benefits

Age 62

With reduced benefits

Age 66 to 67

Social Security full retirement age with unreduced benefits (depends on the year of your birth)

- You can work while you receive Social Security retirement (or survivors) benefits.

- If you begin taking Social Security before reaching full retirement age, there are restrictions on how much you can earn.

- If you earn more than the allowable income, your benefits may be reduced.

- If you want the option of earning more than the legally allowed limit, consider delaying Social Security benefits.

- Regulations are subject to change.

- Before you begin working again after starting your Social Security benefits, make sure you’re aware of the earnings limits.

- Any pension payments (from work for which you paid Social Security taxes) do not count against your Social Security income limits.

- Delaying Social Security benefits also may increase your payments when you decide to start receiving your Social Security benefits.

Pension plan

A pension is an employer-sponsored and funded retirement plan where employee benefits are computed using a formula that considers several factors, such as length of employment and salary history. It costs nothing for employees to participate, and the company is responsible for managing the plan's investments and risk.

Note: check the Your Retirement Benefits (YRB) book for your operating company to see if you are eligible for a FedEx pension plan.

Check the Your Retirement Benefits (YRB) book for your operating company to see if you are eligible for the FedEx pension plan.

If you have a pension plan with FedEx or with a past employer, it’s important to:

- Keep records of employment history, correspondence, and documents relating to your pension benefits

- Read the summary plan description (SPD) (e.g., the SPD for FedEx is the Your Retirement Benefits book) so you understand the rules governing your pension plan

- Check the individual benefit statements you receive for accuracy

- Ask if there are restrictions on your ability to work after you start collecting your benefits

- Keep track of pension benefits available from each company where you have worked

- Make sure to read any notices provided about your retirement plans

- Choose your beneficiaries and keep your selections up to date

If you're eligible for FedEx pension benefits you can learn more by watching the Intro to FedEx Retirement Benefits video on the Video Hub, downloading the pension infographic on your Overview page, or registering for the FedEx Pension Overview webinar on the Course Offerings page.

In some cases, you may need to name a beneficiary to receive pension plan benefits after your death. If you are eligible for a FedEx pension plan, you can designate your beneficiaries here.

If you’re eligible for FedEx pension benefits, you can learn more by watching the Pension Payment Options video on the Video Hub.

If you have a pension benefit with FedEx and need assistance, call the FedEx Retirement Service Center at 1.855.604.6221 Monday through Friday, 8 a.m. to 6 p.m. Central time.

Retiree health

Healthcare costs continue to be one of the largest expenses in retirement. One of the reasons for this is that healthcare inflation is increasing at a rate higher than general inflation. People are also living longer and many are retiring earlier than age 65, which is fantastic news, but it also means you will need to budget for a longer retirement and potentially plan for a gap before Medicare coverage starts at 65.

You need a robust plan to cover healthcare costs – and we have some tips to help you get started.

- Estimate your costs. Use our infographic to estimate potential healthcare expenses in retirement. You can download it on the Plan page under healthcare expenses.

- Consider your timing. Think carefully about when to retire and when to collect your Social Security benefits. Many who retire at 62 rely on Social Security to pay healthcare expenses, but delaying retirement or saving to cover the gap until Medicare kicks in offers the option to postpone your benefit collection. For information about Social Security benefit strategies, visit the Retire page.

- Make catch-up contributions. If you're at least 50, you have an opportunity to take advantage of catch-up contributions in your Retirement Savings Plan. As you approach retirement age, you can contribute additional funds beyond the standard limits. This can provide an additional cushion for healthcare expenses.

- Invest in an HSA. Health Savings Accounts (HSAs) are a tax-efficient method to save for healthcare expenses during retirement. You can learn about the benefits of HSAs by attending the Health Savings Accounts (HSAs) course from Vanguard. Check the Course Offerings page to find the next available course date.

Managing your healthcare costs in retirement can be a challenge. That’s why it’s important to understand what benefits are available to you. If you are eligible for FedEx retiree health benefits, you can review your benefits on the FedEx Retirement Hub overview page for your operating company.

Medicare

Funded through your personal payroll deductions, you will have access to Medicare at age 65; it covers basic medical services but no long-term care expenses. Basic information on Medicare options can be found at medicare.gov or by calling 1-800-MEDICARE (1-800-633-4227).

Medicare offers Part A and Part B plans, and private insurers take up the slack – for a fee – with Medigap plans.

Here is a simple summary of what Part A and Part B cover.

Note: It is important to do your own research. For more information, go to medicare.gov, which provides detailed information on each of the plans available and the ability to compare each in a chart format. It also offers a tool to help you compare costs and coverage.

- Hospitals

- Skilled nursing facilities

- Hospice

- Home healthcare

- Doctor’s fees

If it’s getting close to time to sign up, start your research now. Generally, your initial enrollment period begins three months before you turn age 65.

NOTE: If you continue to work after age 65, you will need to request a letter of creditable coverage so that Medicare will not charge a penalty for late enrollment. Request Medicare part B form by contacting Choose Well Care Connect at 1.833.FDXWELL (339.9355) or at choosewell.fedex.com.

If you have time before you reach retirement, it doesn’t hurt to start the education process. Gathering information over time will help you be better prepared and not totally overwhelmed as enrollment time nears.

To apply for Medicare in a Special Enrollment Period, you must have or had group health plan coverage within the last 8 months through your or your spouse’s current employment.

A Medicare Certificate of Creditable Coverage (Form CMS-L564E) must be requested from FedEx.

Follow these steps to request the completed form:

- Contact Choose Well Care Connect at 1.833.FDXWELL (339.9355) or at choosewell.fedex.com.

- You may make your request as early as three months prior to your retirement/termination from FedEx.

- Include the following:

- Your full name

- Your Employee ID Number

- If you need the form for you only or you and your spouse (if age 65 or older)

- Either your full home mailing address, FedEx email address or personal email address for return of the completed form to you

- Please double check any address you provide to ensure accurate delivery. The completed form includes sensitive data.

- Generally, allow for up to 10 business days, plus any mail time, for completion of your form.

Retiree discounts and privileges

As a FedEx retiree, you may be eligible to take advantage of these retirement discounts and privileges:

You may be eligible for a Retiree Reduced-Rate Shipping account. To be eligible for this benefit, at the time of leaving FedEx, the employee must be at least age 55, have at least five years of permanent continuous service, have voluntarily resigned and have a rehire status of yes or conditional. Spouses and dependent children of eligible employees are also eligible for a Retiree Reduced-Rate Shipping account. If a FedEx retiree dies, the family members of the deceased are no longer eligible for the reduced-rate discount.

To apply, you must complete the FedEx Reduced-Rate Shipping Privilege Retiree Account Number Request Form. Mail or fax the completed request form after your retirement date has been entered in the FedEx Human Resources Information System. You can also email the form to: EmployeeDiscountShipping@corp.ds.fedex.com.

Using fedex.com to prepare retiree shipments is the preferred method of obtaining the Retiree Reduced-Rate Shipping discount. You may take packages directly to a shipping location to obtain the discount as well. You must have a valid FedEx retiree ID badge at the time of the shipment.

It is the retiree’s responsibility to ensure retiree account number information is kept current. This includes updating credit card information at the beginning of the month in which your credit card will expire. You should also update account information if you change home address, telephone number or email address. To update your account information, log in to fedex.com and use Manage My Account. You may also contact FedEx Revenue Services at 1.800.622.1147 regarding account updates.

Retiree reduced-rate shipments are subject to all restrictions and guidelines found on the Employee Discount shipping website at fedex.com, using Manage My Account.

You may be eligible for membership at FedEx Employees Credit Association.

Go to fecca.com for additional information. Member services can be contacted at 1.800.228.8513** (toll-free) or 1.901.344.2500 (Memphis area only) Monday through Friday from 7:30 a.m. to 5:30 p.m. Central time.

**Memphis area calls to the “800” number will result in a busy signal.

You may be eligible for discount airline travel. FedEx has negotiated agreements with certain passenger carriers. The agreements are subject to changes and cancellations at the discretion of the air carrier or FedEx. Retirees*** should contact Global Travel by email at GTPER@fedex.com or by calling 1.901.375.6000 (option 4) to request a Retiree Personal Travel Packet. This packet will be sent to you through email and will provide specific information regarding fare quotes, ticketing, rules of conduct, participating airlines and all other rules, as well as a FedEx Retiree Travel Request Form.

***Please note that retirees from only FedEx Corporation, FedEx Express, and FedEx Corporate Services are currently eligible for personal travel benefits.

The FedEx benefits described on this website are based on a formal plan document or contract. While this information is intended to be accurate, retirement benefits are subject to the detailed provisions of the applicable plan documents. If there is a conflict between this website and the official plan documents, the plan documents always govern. You are not entitled to retirement plan benefits due to a misstatement on or an omission from this website. FedEx reserves the right to amend or terminate any benefit plan at any time and for any reason. This website content does not apply to employees of Federal Express Corporation who are classified as Residential Delivery Driver - Non-DOT effective on or after January 1, 2025